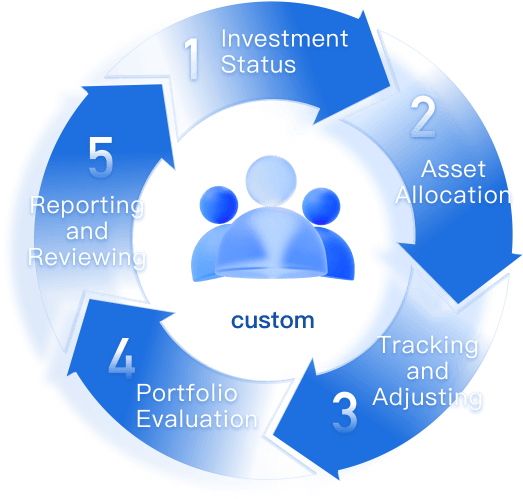

The investment strategy is a general investment approach for different levels of risk and is for reference only. The investment strategy does not take into account your investment objectives and needs or your financial situation and may not be suitable as your investment strategy. The investment strategy may be adjusted from time to time in response to market conditions and other circumstances.

As market conditions are subject to constant and potentially rapid change, the asset allocation and analysis described in this document may become out of date, even within a short period of time. Forthright is under no obligation to monitor and/or update your investment position in the event of changes to the contents of this document or to your risk profile.

Disclosure

Risk Disclosure Statement, the information published herein is for your general information only and does not take into account the investment objectives, financial situation and particular needs of any individual person and does not constitute an offer, solicitation, promotion, inducement, statement of any kind or form of solicitation, offer or invitation, or advice or recommendation to buy or sell any listed or unlisted product mentioned on this page. Services in relation to delegated accounts are only available to professional investors as defined in Chapter 571 of the Securities and Futures Ordinance of Hong Kong.

In the case of an account purchasing an investment product, the lock-up period for the funds will depend on the product.

This information is intended only for persons currently in Hong Kong and, unless otherwise stated, has been prepared by Forthright. Forthright expressly prohibits the distribution or reproduction of all or part of the information published herein without its prior written consent and Forthright shall not be liable to any third party for any such act. In particular, this document may not be distributed in any jurisdiction that restricts its distribution to Forthright.